We all know that developing a brilliant banking talent requires time-tested candidate assessments. Especially today, when banks, as well as their employees, have to keep up with all the new technologies being used in this niche.

But on the other hand, HRs can significantly shorten this process by hiring the right people from the very start. But how can you find technologically proficient personnel, the so-called tech talent, and ensure a consistent customer experience across multiple platforms and devices? This is exactly where candidate assessments for the banking sector fits in.

Hiring for the banking sector in a highly competitive environment needs tremendous research. Let’s explore the new challenges in the recruitment process and see how talent assessment software can help the finance sector, HR, and talent acquisition staff develop brilliant teams and achieve marvelous results.

Top Trends Impacting the Banking Sector

At this point, it’s safe to assume that the banking industry outlook for 2022 will go beyond digital. Numerous technologies, some more than others, have been reshaping the future of the banking landscape including hiring for a while now.

The final result – virtual candidate assessments, automated processes, cut down operation costs, the ability to quickly launch new services and products to adjust to volatile and changing markets, and highly personalized customer service. All of these things created new jobs in the finance sector, a nightmare for the recruitment experts, and confusion in the banking job search process.

Apart from the top 5 skills to become a banker, the specific technology trends have opened doors for banking jobs. It’s no surprise if candidate assessments are framed in these areas:

- Machine Learning: In search of better models of customer service, machine learning has presented itself as the most viable solution. Machine learning in banking has opened many new doors for big data use cases – personalized customer service, the identification of patterns in customer expectations, behavior, and sales forecasting. Thanks to this, the demand for data scientists in the banking sector has drastically increased.

- Artificial Intelligence: AI in the banking sector is used to power process automation and extrapolate the data to deliver a better customer experience. This further increased the demand for tech talent in this sector.

- Blockchain technology: Blockchain in the banking sector will completely reshape the transactions landscape. Thanks to it, transactions can be managed with minimal risk of fraud, completely transparently, and in significantly shorter time frames. All the data in the Blockchain is stored across the entire network in a unique public ledger. Banks across the globe are working on integrating Blockchain to support their day-to-day operations. This creates a demand for distributed computing engineers and cryptographers, more specifically, JavaScript and Solidity programmers.

- Security: As most of the banks’ data, including the private data of their clients, gets digitized, the risks become higher. Cyber crime in banking is thriving, and financial institutions with attractive data can easily become targets of cyber attacks resulting in unpredictable aftermath. This is why banks are stepping up their security game by using cutting-edge security technologies and multiple authentication methods, thus creating more job positions for IT security experts.

“At 2030, I would say that you probably have two billion people that’ll be using day-to-day banking services, independent of banking.”– Brett King, Co-founder, and CEO, Moven

The Advantages of Using AI In the Banking Hiring Process

AI is already being put to use by some of the world’s biggest banks apart from candidate assessments. These are the early AI adopters in the finance industry:

- JPMorgan Chase has invested in a Contract Intelligence platform to analyze legal documents and extract crucial data from them.

- Wells Fargo has already started using Artificial Intelligence Enterprise Solutions. The first solution they’ve implemented is an AI-powered chatbot.

- Bank of America featured Erica – the world’s first intelligent virtual assistant capable of providing financial guidance to customers.

AI has become attractive for the financial sector because it’s capable of streamlining, automating, and improving the hiring process by:

- Significantly reducing hiring time – AI goes through the data and automatically finds the best possible matches for a specific job in the bank hierarchy. This significantly reduces the hiring time and enables HR experts to focus on the most valuable job candidates.

- Completely removing bias from the hiring process – AI doesn’t care about interpersonal relationships. Job applicants cannot charm it unless they have pristine skills and fare well in the candidate assessments as well. Being unbiased, AI makes the hiring process fair and delivers great results.

- Reducing human error – By automating boring and repetitive tasks, AI prevents human errors from occurring in this flaw-sensitive process. The decisions it makes are strictly based on the data on job applicants and pre-set hiring criteria.

The Benefits of Candidate Assessment Software for Banking Sector

As the customers become increasingly tech-savvy, banks have to respond by digitizing their services, and this cannot be done without the technical staff on board. Powered by AI, candidate assessments software brings all the benefits mentioned above and then some. The banks are already using this solution to make the most of assessments for hiring, cut through the noise of the under-qualified employees, and battle tech talent shortage.

Candidate assessments software features several different tests for different types of banking jobs. It allows the recruiters to identify the best candidates, the ones who will be able to grow together into a brilliant team. These tests are:

- Standard Recruitment Tests – By allowing you to distribute dozens of recruitment tests with a single click of a button, candidate assessments software makes testing easy, less time-consuming, and more efficient.

- Psychometric Tests – Psychometric tests are also easy to deploy through a talent assessment solution. They can be used for quickly and efficiently sorting many job applicants. If you decide to use them, rest assured that you’ll be able to quickly narrow down your options for the last recruitment phase.

- Vocational Assessments – To develop a brilliant team, you will have to use vocational assessments. Candidate assessments software gives you the opportunity to determine the job applicants’ interests, psychological makeup, social behaviors, values, and attitudes; everything you’ll need to build a dream team in your organization.

When it comes to sourcing talent, candidate assessments software, Glider was built to help you find the perfect match. Since the future of banking is closely tied to the use of AI, Glider was built on it so that it can help banks streamline and automate the recruitment process. It allows you to match the best job candidates to a specific spot in every team, including IT.

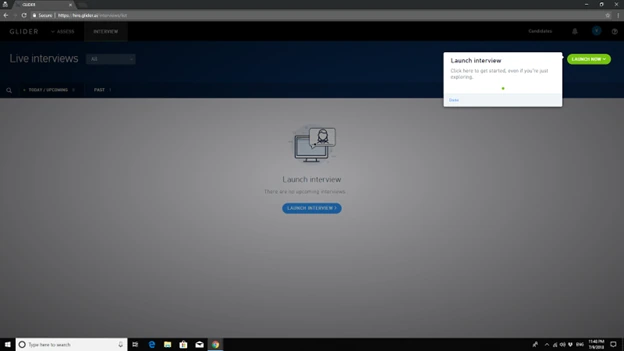

Glider AI’s candidate assessments features an intuitive UI and is easy to use. In fact, you will be able to use it to its full capacity even with a limited technical background. With built-in contextual help, you will be able to master it in no time.

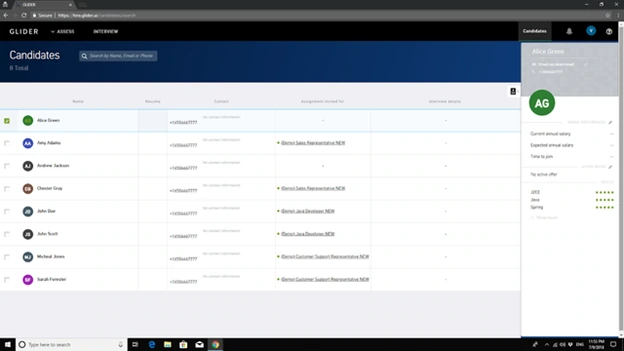

In the candidate’s tab, you can quickly browse through your job candidates, review candidate assessment scores, and proficiency, and invite them to interviews.

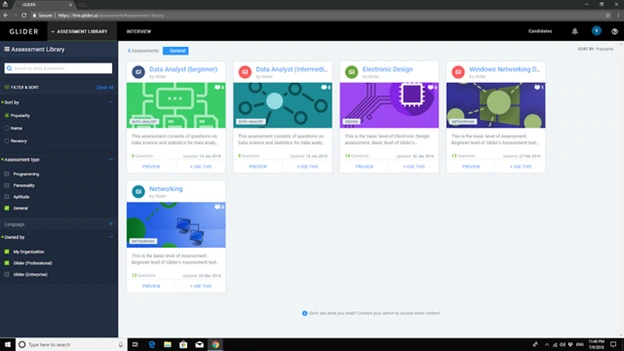

As you can see in the picture below, Glider integrates dozens of pre-built assessment softwares to help you speed up your hiring process and base your decisions on accurate data.

Careers in banking sector are going to grow only bigger and better. Candidate assessments software powered by AI will help you identify the best job candidates, make your recruitment process efficient, build brilliant teams, and ultimately bring a stronger organization.